Teenage Money Management App - Never too young to learn the value of money. Money apps for kids, teens, and young adults abound, but which one is best for your family?

Trust the integrity of our balanced and independent financial advice. However, we can get compensation from the manufacturers of some of the products mentioned in this article. Opinions are those of the author only. This content is not provided, verified, approved or endorsed by any advertiser, except as noted below.

Teenage Money Management App

I grew up with many financial lessons from my parents. Unfortunately, I learned most of it from watching my parents make bad decisions that I was determined not to repeat. We also don't have much financial education in school, only devoting a few days to things like writing checks and calculating interest.

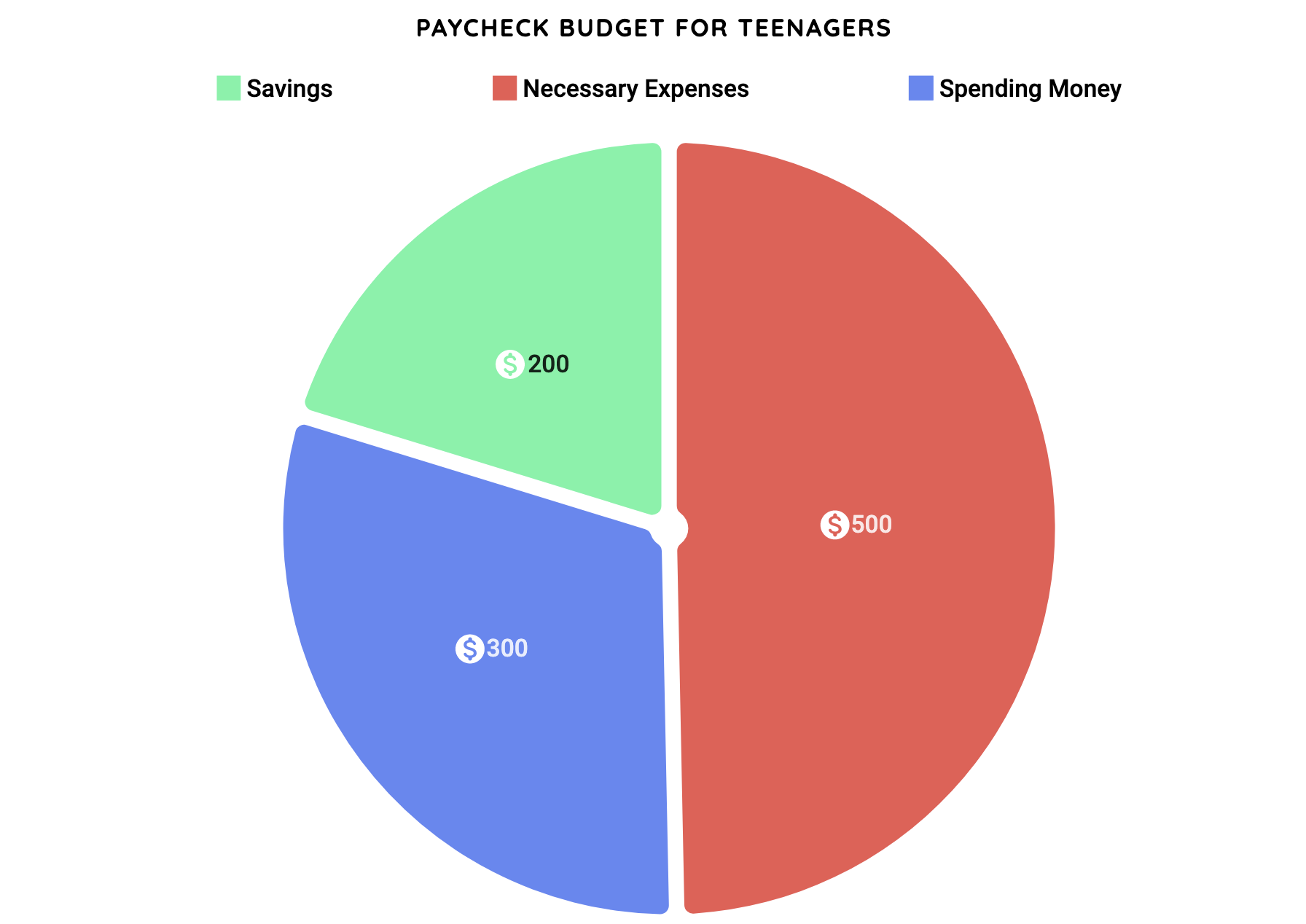

How Much Should A Teenager Save From A Paycheck

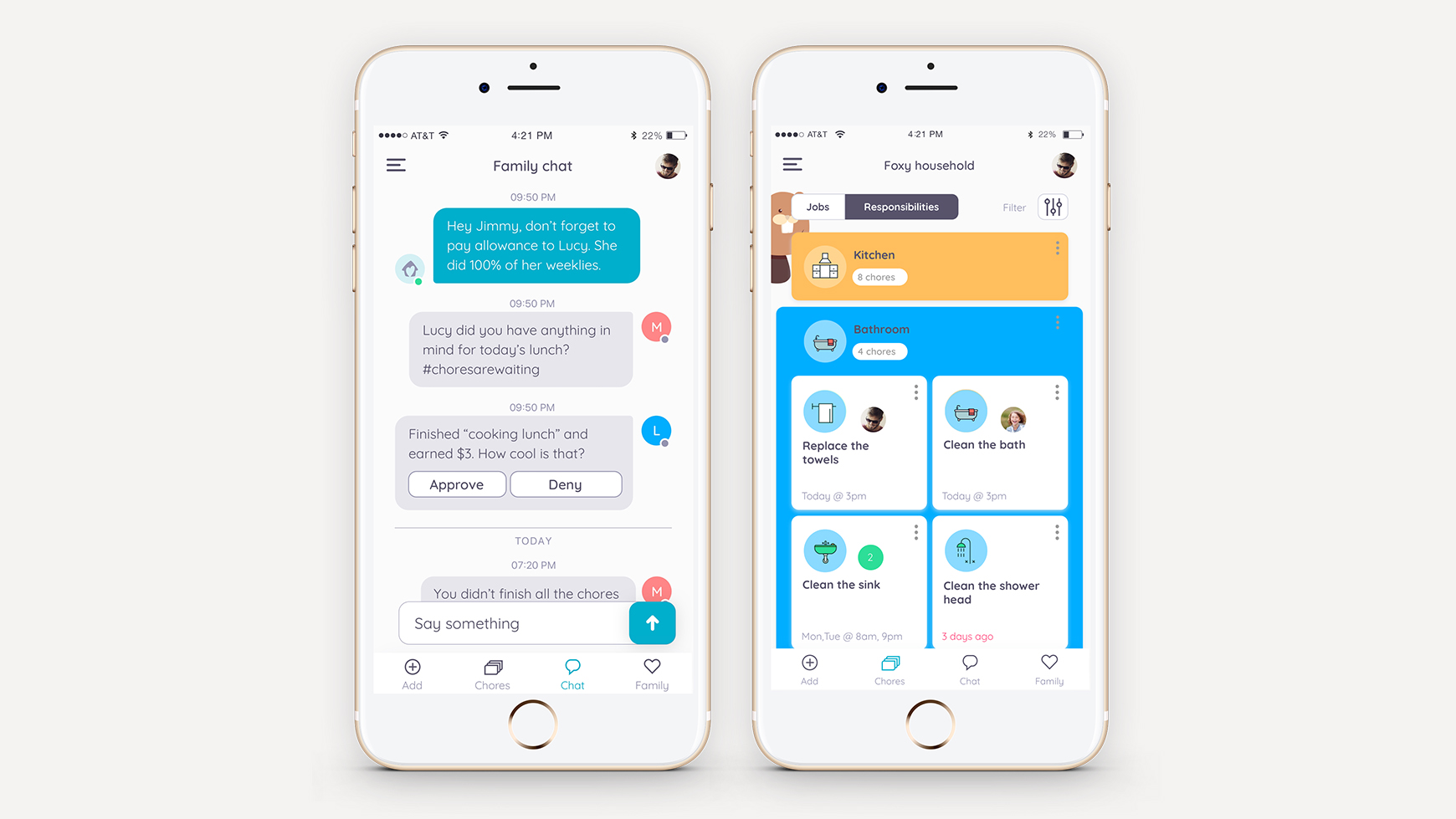

Parents today have the power to do more for their children's futures, and they have incredible tools - like apps and money platforms - to help them do that. With the app, parents can pay their kids for work or allowances, track their expenses, teach them about saving and budgeting, and even guide them with their first investment.

One of our favorite tools for adults to track their finances is Personal Capital. It's free and has many features to help you organize your financial life. Read our Personal Capital Review here.

Now if you're considering a money app for your child, teen, or young adult, below are some of our favorites.

The finance app you choose depends on your child's age and experience with money. No matter how old your child is or how long they've been learning about finance, there are some specific focus points to consider when browsing apps.

Debit Card & App Benefits For Teens

Would you like to give your child a fixed allowance? What about offering money in exchange for homework and assignments?

Many apps allow both. Some make it easy to automate weekly or monthly payments, while others allow you to set tasks for your child to check off upon completion.

Whether it's 6, 16, or 26, it's important for your child to learn how to stay on a budget. That means knowing their financial situation, what they can afford, planning big expenses ahead of time, and learning how to say no.

I work regularly with my 8 year old to teach him the difference between short-term and long-term saving and to develop the patience required for each. Most of these money apps can help bring that lesson home.

Mobile Banking App Current Raises $20m Series B, Tops Half A Million Users

Whether you just want your child to put aside a portion of their income each month or they want to buy an expensive toy, savings lessons make it easier.

Older children can begin learning the value of investing long before they are ready to build their first portfolio. Once they (or you) are ready, you can also open an investment account for them that will benefit from years of growth.

Don't spend what you don't have. Browse for great deals. Only buy what you need. Learn to live without some of your desires.

This is a great lesson for both children and adults. The right money app can help your kids track their spending, update their available funds and allow you, as a parent, to keep an eye on where their money is going while teaching them to analyze where their money is going money flows.

Online Jobs For Teens (13 18 Year Olds) To Make Money Online

Here are some of the best money apps we've found for younger kids. While most are geared toward 6-12 year olds, only you know what's best for your child and their financial capabilities.

Rooster Money is one of the most comprehensive family finance apps out there. It is feature rich and has thought of everything. Their basic platform (virtual tracker) is free and is aimed at children aged 3+. An updated version, Rooster Plus, covers the whole family for $18.99 per year, tracking everything from chores and errands to savings goals.

Rooster Money allows for a spend/save/give approach while still allowing you to consider recurring expenses (like subscriptions) to teach budgeting skills. You can also encourage saving by offering personalized interest rates to your children.

I personally like PiggyBot because it uses the shop/save/share concept that I've been teaching my boys for years. The platform is easy enough for young children to understand, but comprehensive enough for teenagers.

Money Tracker & Finance Management Tools

With PiggyBot, you and your kids can have a virtual promissory note account where they can see exactly their financial situation. It covers savings goals, current spending, and even stock funds.

Keep track of your child's allowances and expenses virtually with Allowance+, with the ability to set chores and chores or set up recurring allowance payments. The app is free to use, but you can also pay a small monthly fee if you want to connect multiple devices for multiple kids.

As your kids get older and into their teens (or even pre-teens), they'll need more than just their money app.

Most users of Bankaroo are between the ages of 5 and 14, making it a good choice for a wide range of children. No wonder kids love this app too, considering it was made by an 11 year old (and his dad)! We'd say it's suitable for teens, pre-teens and younger teens.

Parent's Checklist: 6 Things To Look For Before Downloading Apps For Kids

With Bankaroo, your kids can keep track of their money virtually, taking into account allowances, savings goals and expenses. However, one-time jobs and tasks are not supported. While it doesn't require a bank account, it makes it easier to know where your kids stand at all times — rather than having them try to remember how much savings they have at home when they see something they want at the store .

Developed in partnership with Mastercard, Gohenry is a financial literacy app and debit card platform for 6-18 year olds. With parental control for each child and no worries about overdrafts, gohenry makes it easy for your kids to learn finance lessons in real time. They can also access and share personalized gift links so anyone can send them money for a birthday or holiday.

BusyKid has almost all the finance features you need when trying to teach your teen about money. From earning and saving to budgeting and investing, the BusyKid platform does it all. You can also set age-appropriate tasks and grant allowances.

With the BusyKid prepaid card, you can let your child shop wherever Visa is accepted. On the go, you can monitor this activity and even receive push notifications. Also, BusyKid is the only kids app that allows kids to invest in real stocks with their pocket money.

Budgeting And Money Management For Young Adults

With automatic allowances, in-app to-do lists, and real-time parent notifications, Greenlight teaches financial lessons and keeps parents informed. MasterCard debit cards are available to let kids spend where they want, with flexible parental control options - you can even set store-specific spending controls.

As your kids grow up, get jobs, and even go to college, learning how to successfully manage their own finances is even more important. This requires apps that offer more flexibility and features, perhaps allowing parents to send money and monitor progress.

A great app for older teens, especially those going to college, is FamZoo. It assigns a purpose to every dollar your child earns and spends, incentivizes them, and helps track savings progress.

As the name suggests, FamZoo is designed for the whole family and empowers children of all ages. There are also two versions of the platform: one is virtual and works as a promissory note, while the other involves real money and prepaid cards.

Banking App For Teens To Boost Money Management Skills Among Young Emiratis

You may already know Acorns as a comprehensive platform that helps you save, spend and invest better. However, with Acorns Early you can give your kids a head start on their own financial health and it takes less than 3 minutes to open an account.

Acorns Early includes a healthcare system with integrated checking, retirement, and savings accounts. Also, you can set up recurring investments for multiple children in UTMA/UGMA accounts that can be transferred to your children when they grow up.

One of the best things you can do for your children's financial future is to start teaching important lessons early on. You can do this too, no matter the age of your kids - kids as young as 3 can understand the concept of tasks and rewards and save.

As your kids grow, using a finance app can make it easier for them and you to keep track of their savings, monitor expenses, set financial goals, and even keep up with chores. Whether you choose a virtual piggy bank or an app that keeps your money in a real bank account, the financial lessons you teach your kids today will follow them for a lifetime.

Smart Money Awards: The Best Financial Apps And Services Of 2022

Stephanie Colestock is a distinguished financial writer based in Washington, DC. His work can be found on sites like Investopedia, Credit Karma, Quicken, The Balance, Motley Fool, and more, and covers a wide variety of topics including family finance, planning for the future, optimizing credit, and more

Teenage money, teenage money management tips, teenage anger management counselling, teenage anger management programs, best teenage phone monitoring app, anger management for teenage son near me, help with teenage anger management, teenage anger management counselling near me, personal money management app, teenage money management, best money management app, free money management app

.jpg)

0 Comments